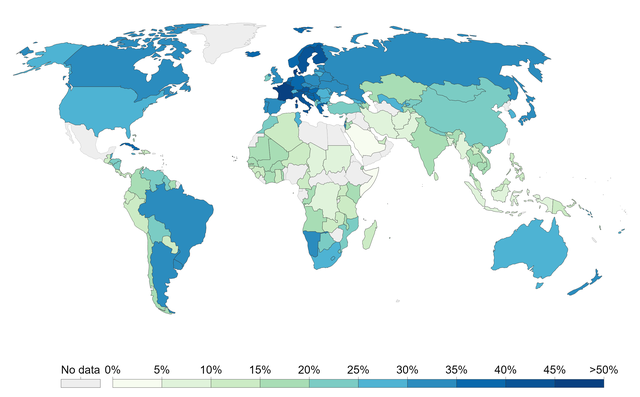

List of countries by tax revenue to GDP ratio - Wikipedia

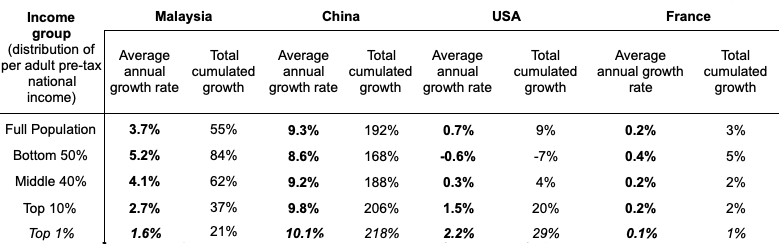

Income inequality among different ethnic groups: the case of

Tax guide for expats in Malaysia - ExpatGo

What Is the Difference Between the Statutory and Effective Tax Rate?

Corporate Tax Rates Around the World, 2019 Tax Foundation

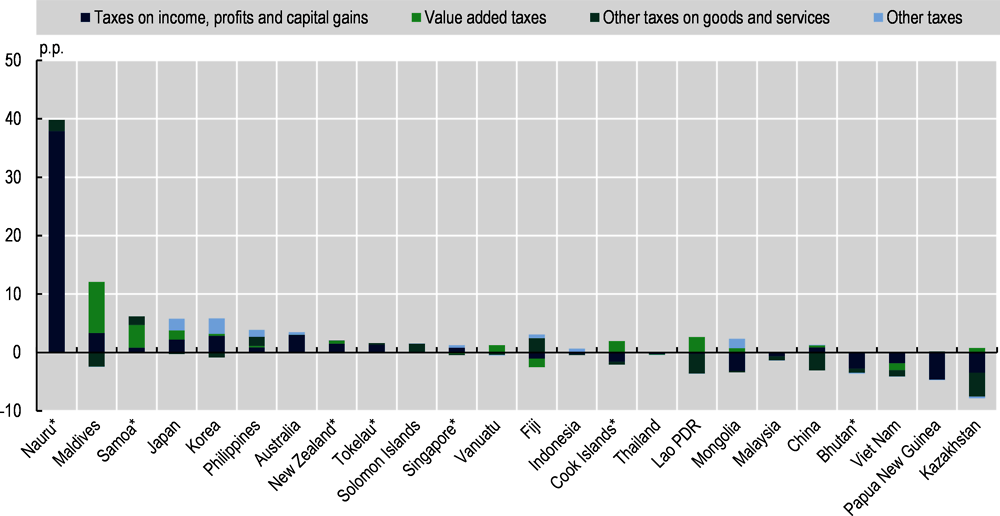

1. Tax revenue trends in Asian and Pacific economies Revenue

Cover Story: Budget 2020: Top tax bracket raised to 30%, TIN

What Is the Difference Between the Statutory and Effective Tax Rate?

Big Tech tax burdens are just 60% of global average - Nikkei Asia

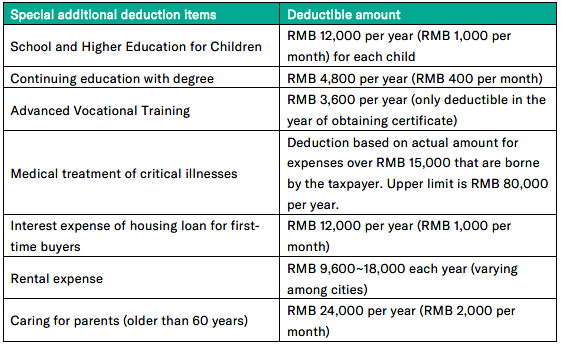

The revolution in China individual income tax law as of 2019

Malaysia: government revenue Statista

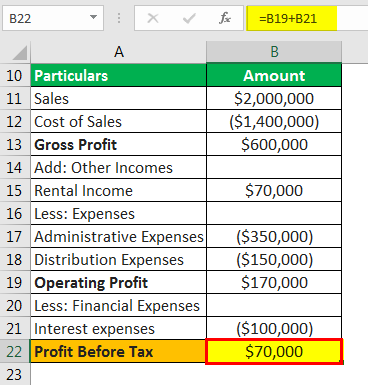

Provision for Income Tax (Definition, Formula) Calculation Examples

Tags:

archive